Finance Fighter: India's Most Popular Financial Strategy Game

Introduction to Finance Fighter

Finance Fighter is revolutionizing how Indians learn about money management through an engaging gaming experience. Launched in 2021 by Daman Games, this financial strategy game has quickly become a national sensation, combining education with entertainment in a way that resonates deeply with Indian players.

The concept is brilliantly simple yet powerful: players start with a modest amount of Indian rupees and navigate various financial scenarios uniquely designed for the Indian market. From managing daily expenses to investing in stocks, real estate, and even gold – Finance Fighter covers all aspects of personal finance as experienced in India.

What makes Finance Fighter truly stand out is its authentic representation of India's financial landscape. Unlike generic financial games developed for Western markets, this game understands the nuances of Indian financial habits, investment preferences, and economic challenges.

Whether you're a college student in Pune learning about budgeting for the first time, a small business owner in Jaipur looking to understand investments, or a homemaker in Kolkata wanting to manage household finances better – Finance Fighter offers valuable lessons wrapped in an entertaining package.

Finance Fighter's Impressive Growth in India

Available in 18 Indian languages, Finance Fighter has made financial education accessible across linguistic barriers. The game's popularity spans all age groups, with a significant player base among young adults aged 18-35 who are just starting to manage their finances independently.

Educational institutions across India have even started recommending Finance Fighter as a supplementary tool for teaching financial literacy. Several banks and financial institutions have partnered with the game's developers to create custom content that helps players understand real-world financial products and services.

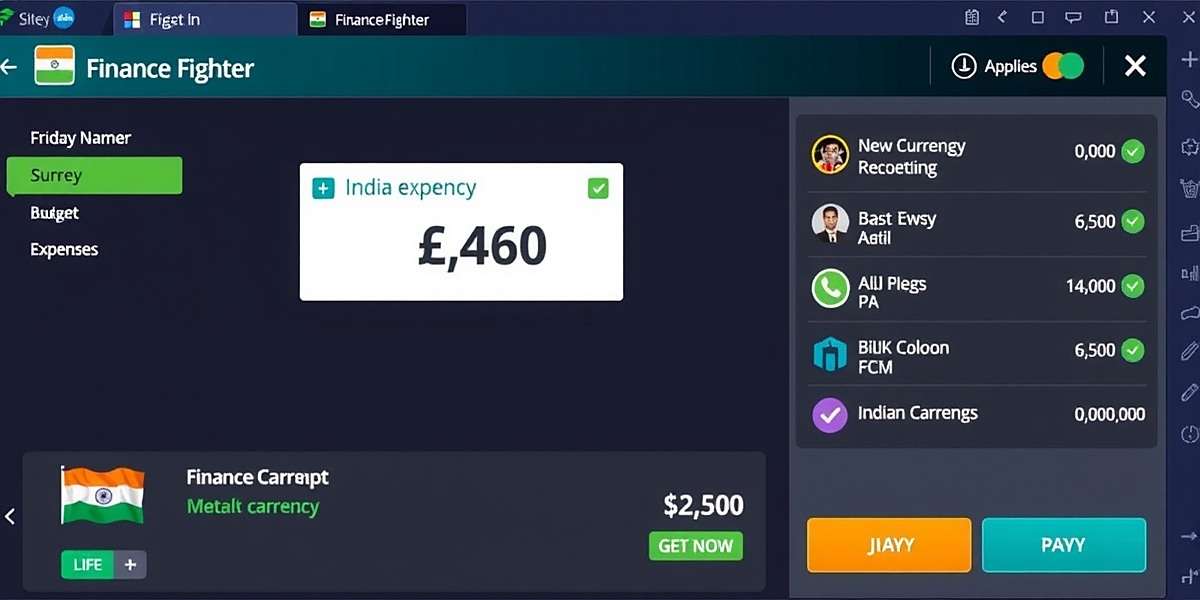

Gameplay of Finance Fighter

Finance Fighter offers a gameplay experience that is both educational and entertaining, with mechanics designed to teach financial concepts through practical application. The game is structured to simulate real-life financial journeys that Indian players can relate to.

Players begin their journey as a young professional in one of India's major cities, starting with a fixed salary and basic expenses. As they progress, they face financial decisions that mirror real-life choices: renting vs. buying a home, investing in mutual funds vs. fixed deposits, managing medical emergencies, and planning for retirement.

Core Gameplay Mechanics

The core mechanics of Finance Fighter revolve around making sound financial decisions within the context of Indian economic conditions:

Players receive monthly income based on their chosen profession (software engineer, doctor, small business owner, etc.), with salaries reflecting current Indian market rates. Additional income can be earned through side hustles, investments, and financial challenges.

From rent/mortgage payments to groceries, utility bills, and unexpected expenses like medical emergencies or vehicle repairs – players must balance their spending with their income. The game includes uniquely Indian expenses such as festival shopping, puja expenses, and family contributions.

Players can invest in various instruments familiar to Indian investors:

• Fixed Deposits with varying interest rates from major Indian banks

• Mutual Funds including equity, debt, and hybrid options from Indian AMCs

• Stock Market featuring top NSE/BSE listed companies

• Gold investments (physical, ETFs, and sovereign gold bonds)

• Real Estate properties across different Indian cities and localities

• Cryptocurrency (with educational warnings about risks as per RBI guidelines)

Players set and work towards financial goals that reflect Indian life milestones:

• Saving for higher education (engineering, medicine, MBA)

• Buying a two-wheeler, car, or home

• Planning for marriage expenses

• Building a retirement corpus

• Creating an emergency fund

• Saving for children's education and marriage

Players learn about insurance products relevant to Indian consumers:

• Term life insurance with various riders

• Health insurance including family floater plans

• Vehicle insurance (two-wheeler and car)

• Home insurance

The game simulates unexpected events like accidents, illnesses, and natural disasters to highlight the importance of insurance coverage.

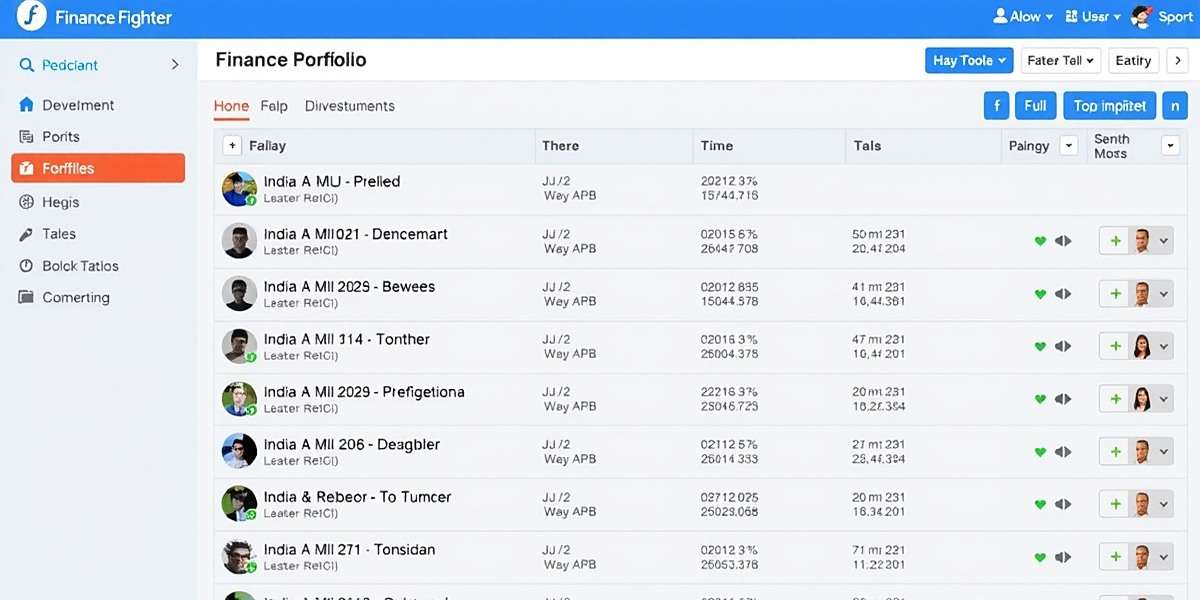

Progression System

Finance Fighter uses a unique progression system based on financial knowledge and portfolio growth rather than traditional gaming levels. As players make sound financial decisions, they earn:

• Financial Intelligence Points (FIP): Earned by making optimal financial decisions, completing educational modules, and passing financial quizzes. FIP unlocks advanced financial instruments and strategies.

• Wealth Rank: Based on the total net worth of the player's portfolio. Ranks range from "Financial Novice" to "Wealth Creator" and finally "Financial Guru."

• Special Badges: Awarded for achieving specific financial milestones like "Emergency Fund Master," "Tax Saver," "Real Estate Mogul," and "Gold Investor."

• Expertise Levels: In different financial domains such as investing, tax planning, insurance, and retirement planning. Higher expertise unlocks specialized strategies and insights.

Indian Economic Events

The game incorporates dynamic Indian economic events that affect players' finances, just like in real life:

• Union Budget announcements and their impact on taxes and investments

• RBI policy changes affecting interest rates

• Stock market fluctuations based on real Indian market trends

• Festive season effects on spending and investment opportunities

• Monsoon predictions impacting agricultural investments

• Changes in GST rates affecting business owners

These events teach players to adapt their financial strategies to changing economic conditions, a crucial skill in India's dynamic economy.

Downloads, Platforms, and Localized Versions

Finance Fighter is available across multiple platforms to ensure accessibility for all Indian users, regardless of their device preferences:

• Android: Available on Google Play Store with a download size of 85MB, optimized to work on low-end devices with Android 7.0 and above.

• iOS: Available on Apple App Store for iPhone and iPad, requiring iOS 12.0 or later.

• Web Version: A browser-based version at https://damangames.center that offers full functionality without downloading.

• Feature Phones: A lightweight version for KaiOS devices, making the game accessible to users with basic mobile phones.

Regional Adoption in India

Finance Fighter has seen remarkable adoption across all regions of India, with particularly strong growth in urban areas and Tier-2 cities:

• Maharashtra – 22% of total downloads, led by Mumbai, Pune, and Nagpur

• Karnataka – 17% of total downloads, with Bangalore as the top market

• Delhi NCR – 15% of total downloads, including Gurgaon, Noida, and Ghaziabad

• Tamil Nadu – 14% of total downloads, driven by Chennai, Coimbatore, and Madurai

• Telangana – 10% of total downloads, primarily from Hyderabad and Warangal

• Gujarat – 8% of total downloads, with Ahmedabad and Surat leading

• Rest of India – 14% of total downloads, showing strong nationwide appeal

The game's popularity has been boosted by its relevance to India's growing middle class, which is increasingly focused on financial planning and wealth creation.

Localized Versions and Language Support

Understanding India's linguistic diversity, Finance Fighter offers fully localized experiences in 18 Indian languages, with region-specific content in each version:

• Hindi – 45% of players, with content tailored for different Hindi-speaking regions

• Bengali – Popular in West Bengal, with examples based on Kolkata's economy

• Tamil – Featuring financial scenarios relevant to Tamil Nadu's economy

• Telugu – With examples from Andhra Pradesh and Telangana's business environment

• Marathi – Including references to Maharashtra's unique financial culture

• Gujarati – With content focused on Gujarat's business community and traditions

• Kannada – Featuring scenarios relevant to Karnataka's economy

• Malayalam – Popular in Kerala, with content reflecting local financial habits

• Punjabi – Including examples from Punjab's agricultural and business sectors

• Odia – With scenarios relevant to Odisha's economic conditions

• Urdu – Popular in northern India, with content adapted for local financial practices

• Assamese – Catering to players in Assam and Northeast India

• Konkani, Nepali, Rajasthani, Bhojpuri, Haryanvi, and Maithili – Added based on player demand

Each language version includes region-specific financial scenarios. For example, the Punjabi version includes agricultural loan management and crop insurance, while the Gujarati version features more business investment scenarios reflecting the state's entrepreneurial culture.

The game also adjusts currency denominations and price points based on regional economic conditions, making the financial scenarios more realistic for players across different parts of India.

Player Reviews and Ratings

Finance Fighter has received exceptional reviews from Indian players, with an average rating of 4.8 out of 5 across all platforms. With over 1.8 million reviews, it's one of the highest-rated financial education apps in India.

What Indian Players Love Most

Indian players particularly appreciate several aspects of Finance Fighter that make it stand out from other financial games:

• The authentic Indian context that makes financial concepts relatable and practical

• Clear explanations of complex financial products like ELSS, PPF, and term insurance

• Realistic simulation of financial challenges faced by middle-class Indians

• Educational value that helps players make better financial decisions in real life

• Regional customization that reflects local financial practices and terminology

• Engaging gameplay that makes learning about finance enjoyable rather than tedious

Player Testimonials from Across India

"Finance Fighter has completely changed how I manage my money! As a software engineer in Gurgaon, I was struggling with saving despite a good salary. The game taught me about ELSS funds and tax planning in a way that no article or video could. Now I'm actually investing regularly and seeing my money grow. The Delhi-specific scenarios with high rent and commuting costs are so relatable!"

"I've tried many financial apps, but Finance Fighter is different because it understands the Indian context. The Kannada version helped my parents finally understand mutual funds after years of me trying to explain! The game's simulation of job switches in Bangalore's IT sector and the accompanying salary negotiations are spot on. The health insurance module taught me things I didn't know even after working in HR for 3 years!"

"As a small business owner in Ahmedabad, Finance Fighter has been invaluable for understanding GST and business loans. The Gujarati version uses terms I'm familiar with, and the scenarios reflect the challenges of running a small shop in Gujarat. I especially like the festival season modules that teach you to plan for Diwali expenses and take advantage of the shopping season. The only reason I'm not giving 5 stars is that I want more content on export business!"

"I downloaded Finance Fighter thinking it would be just another game, but it's transformed my financial life! As a teacher, I never understood investing, but the game's step-by-step approach made it easy. The Telugu version is beautifully done, with examples that reflect our culture—like saving for children's education and managing marriage expenses. I've even started a SIP in real life after learning about it in the game. My husband now plays too, and we discuss our 'game strategies' when making real financial decisions!"

"Finance Fighter ka Bhojpuri version bahut achcha banaya gaya hai! (The Bhojpuri version of Finance Fighter is very well made!) As someone who manages both farming and a small shop, I found the game's agricultural loan and crop insurance modules extremely useful. The game taught me about government schemes I didn't know existed. I wish there was more content about seasonal farming income, but overall it's a fantastic way to learn about money management."

Expert and Critic Reviews

Financial experts and educators in India have praised Finance Fighter for its innovative approach to financial literacy:

Dr. Meera Patel, Financial Educator and Author, said: "Finance Fighter addresses a critical gap in India's financial education landscape. By contextualizing financial concepts within Indian scenarios and making learning interactive, it achieves what traditional financial education has failed to do—actually engage people in learning about money management."

Indian Financial Times noted: "What makes Finance Fighter remarkable is its ability to simplify complex financial products like ULIPs and ELSS funds without oversimplifying. The game respects the intelligence of its players while making financial education accessible to all, regardless of background or education."

Several Indian universities and business schools have incorporated Finance Fighter into their curricula, recognizing its effectiveness in teaching practical financial skills to students.

Indian Player Strategies for Finance Fighter

Indian players have developed sophisticated strategies for succeeding in Finance Fighter, many of which translate directly to real-life financial success. Top players from across India share their proven approaches:

Beginner Strategies for New Players

- Prioritize the emergency fund first: Just like financial advisors recommend in real life, top players always build a 6-month emergency fund before investing. This protects you from setbacks like medical emergencies or job loss in the game.

- Start small with SIPs: Use the Systematic Investment Plan feature for mutual funds, starting with small amounts. The power of compounding works similarly to real life in Finance Fighter.

- Take advantage of tax-saving instruments: The game rewards players who use Section 80C investments like PPF, ELSS, and life insurance to reduce their tax liability.

- Learn the difference between good and bad debt: Taking loans for appreciating assets like real estate can be beneficial, while high-interest debt for consumption items should be avoided.

- Complete the tutorial modules: Even experienced players recommend completing all educational modules, as they contain India-specific financial insights you won't find elsewhere.

Advanced Strategies from Top Indian Players

Portfolio Diversification Indian Style: Top players recommend a portfolio allocation that reflects India's unique investment landscape: 30% in equity (stocks and equity funds), 25% in fixed income (FDs, debt funds), 20% in real estate, 15% in gold, and 10% in cash. This allocation balances the unique risks and opportunities in the Indian market.

Festival Season Planning: Indian players have mastered the art of preparing for India's major festivals, which impact both expenses and investment opportunities in the game:

"I always increase my liquid funds before Diwali and Dussehra in the game," says Rajesh Kumar from Chennai, a top 0.1% player. "There are always good investment opportunities during the festival season sales, and you need quick access to funds. Plus, you have to budget for gifts and celebrations just like in real life!"

Tax Harvesting: Advanced players use tax-loss harvesting strategies during March in the game, mirroring real-life end-of-financial-year practices in India. By selling underperforming investments to offset capital gains, players minimize their tax liability while rebalancing their portfolios.

Real Estate Investment Timing: Seasoned players know that property prices in the game follow patterns similar to real Indian markets. "I always look to buy property during the monsoon season in the game when prices are lower," explains Priya Sharma from Mumbai. "Just like in real Mumbai, developers offer better deals during the rainy season when fewer people are house hunting."

Regional Strategies from Different Parts of India

North India Strategy: Players from Delhi, Punjab, and Haryana emphasize the importance of gold investments. "In our culture, gold is both an investment and part of our traditions," says Amandeep Singh from Chandigarh. "I always maintain at least 20% of my portfolio in gold in Finance Fighter, which serves me well during market downturns, just like in real life."

South India Approach: Players from Tamil Nadu, Karnataka, and Kerala focus on systematic investments and long-term planning. "We have a tradition of saving regularly, even small amounts," explains Lakshmi Narayanan from Coimbatore. "In Finance Fighter, I use multiple small SIPs rather than one large investment, which helps me average out market fluctuations."

East India Tactics: Players from West Bengal, Bihar, and Odisha prioritize fixed income and real estate. "In our region, people trust physical assets more than market-linked investments," says Subhash Chatterjee from Kolkata. "I allocate more to FDs and property in the game, which aligns with our financial culture while still achieving good returns."

West India Methods: Players from Maharashtra, Gujarat, and Rajasthan focus on business investments and tax optimization. "We're naturally entrepreneurial," says Neha Shah from Ahmedabad. "In Finance Fighter, I always look for business expansion opportunities and use every available tax deduction, which mirrors our approach to real-world finance."

Life Stage Strategies

Young Professional (22-30): Focus on building an emergency fund, paying off education loans, and starting small investments in equity funds. Take advantage of the game's "side hustle" opportunities to increase income.

Married with Young Children (30-40): Prioritize life and health insurance, start education savings plans, and balance home loan payments with retirement investments. The game's child education calculator is particularly useful for this stage.

Mid-Career (40-50): Increase retirement contributions, pay down major debts, and start shifting portfolio towards more conservative investments. Use the game's retirement planning tools to ensure you're on track.

Pre-Retirement (50-60): Focus on capital preservation, maximize retirement accounts, and plan for healthcare expenses. The game's pension planning module helps players understand various retirement income options available in India.

Local Events and Community Features

Finance Fighter has built a thriving community of Indian players through regular events and features that encourage learning and competition. These community elements have been crucial to the game's sustained popularity across India.

Seasonal Financial Events

The game hosts regular events tied to Indian financial calendars and festivals, providing players with opportunities to learn about seasonal financial practices:

Jan-Feb Tax Planning Season – Special events focused on tax-saving strategies, with challenges based on Section 80C, 80D, and other Indian tax provisions. Players who optimize their tax planning earn special rewards and badges.

Mar-Apr Financial Year End – Events centered around closing books, evaluating investments, and planning for the new financial year. Features real-life tasks like submitting investment proofs and rebalancing portfolios.

Jun-Jul Monsoon Investment Festival – Focused on agricultural investments, insurance against natural calamities, and seasonal business opportunities. Players learn about crop insurance and weather-based investment strategies.

Oct-Nov Diwali Wealth Creation – The biggest event of the year, featuring special investment opportunities, gold purchase challenges, and planning for festival expenses. Players receive Diwali bonuses and can participate in Lakshmi Puja-themed financial rituals for in-game rewards.

Dec Year-End Financial Review – Events focused on evaluating the year's financial performance, setting goals for the coming year, and learning from financial mistakes. Features personalized financial reports for each player.

Community Competitions

Finance Fighter offers various competitions that bring players together and encourage healthy financial practices:

• Wealth Creation Challenge: Monthly competitions where players start with equal amounts and compete to build the highest net worth using sound financial strategies.

• Tax Optimization Contest: Special events where players compete to minimize tax liability while maximizing investments, with realistic scenarios based on Indian tax laws.

• Regional Financial Leagues: Players compete against others from their state or city, fostering local pride and regional financial knowledge sharing.

• Inter-Company Challenges: Corporate teams can compete against each other, with companies often using this feature for financial wellness programs for employees.

• Student Finance Competitions: University and college teams compete in financial challenges relevant to students, with prizes including scholarships and financial literacy resources.

Community Learning Features

The Finance Fighter community is built around shared learning and financial empowerment:

• Financial Guru Program: Top players can become mentors for new players, sharing strategies and answering questions. Mentors earn special in-game rewards and recognition.

• Regional Knowledge Hubs: Community forums organized by language and region, where players share financial tips specific to their local economic conditions.

• Expert Q&A Sessions: Regular live sessions with Indian financial experts, where players can ask questions about both the game and real-world financial topics.

• Success Story Sharing: Players share how skills learned in Finance Fighter have helped them in real life, inspiring others to apply financial lessons.

• Financial Myth-Busting Campaigns: Community-driven initiatives to address common financial misconceptions in India, like "investing in stocks is gambling" or "only rich people need insurance."

Community Impact Initiatives

Beyond gameplay, Finance Fighter has leveraged its community for positive financial impact across India:

• Financial Literacy Drives: Players organize local workshops to teach financial concepts to non-players, with the game providing educational materials.

• Microfinance Challenges: Special events where in-game achievements translate to real microloans for entrepreneurs in rural India through partner NGOs.

• Women's Financial Empowerment: Special campaigns focused on increasing financial literacy among women, with female financial experts and role models featured regularly.

• Rural Financial Inclusion: Initiatives to make the game and its lessons accessible to rural players, with simplified versions and regional language support.

Educational Partnerships and Impact

Finance Fighter has transcended being just a game to become a recognized educational tool in India, forming partnerships with various institutions to promote financial literacy:

Academic Institutions

Over 300 colleges and universities across India have incorporated Finance Fighter into their curricula, particularly in commerce, business, and economics departments. Notable partnerships include:

• Delhi University – Uses the game in its financial literacy program for undergraduate students

• Indian Institute of Management (IIM) Ahmedabad – Incorporates the game into its executive education programs

• Mumbai University – Uses the game in its commerce curriculum to teach practical financial management

• Anna University – Uses the Tamil version in its business courses for engineering students

Educators report that students who use Finance Fighter demonstrate better understanding of financial concepts and higher engagement with financial education compared to traditional teaching methods.

Banking and Financial Partners

Several major Indian financial institutions have partnered with Finance Fighter to create authentic educational content:

• State Bank of India – Contributed content on savings accounts, loans, and government schemes

• HDFC Life – Developed modules on life insurance and retirement planning

• Kotak Mahindra Bank – Created content on mutual funds and investment strategies

• National Stock Exchange (NSE) – Provided real-time market data for the game's stock market simulations

These partnerships ensure that the financial products and scenarios in the game accurately reflect real options available to Indian consumers.

Government and NGO Collaborations

Finance Fighter has partnered with various government initiatives and NGOs to promote financial inclusion across India:

• National Centre for Financial Education (NCFE) – Collaborative content development for financial literacy

• Pradhan Mantri Jan Dhan Yojana – Educational modules about basic banking for rural players

• Self-Employed Women's Association (SEWA) – Special content for women entrepreneurs in rural areas

• NABARD – Agricultural finance modules for players in rural areas

These collaborations have helped make financial education accessible to underserved populations across India.

Future Updates and Roadmap

The developers of Finance Fighter have announced ambitious plans for future updates based on player feedback from across India:

• Small Business Expansion: Enhanced modules for small business owners, including GST management, inventory control, and business loan applications with scenarios specific to Indian small businesses.

• Agricultural Finance: Expanded content for farmers, including crop loan management, commodity trading, government agricultural schemes, and weather-based insurance products.

• Retirement Planning for All: New modules focusing on retirement options for informal sector workers, who make up a significant portion of India's workforce, including EPF, NPS, and voluntary savings plans.

• Family Finance Management: Multi-player family mode where players manage household finances together, making decisions about shared expenses, investments, and financial goals.

• Financial Crime Prevention: New content teaching players to识别 and avoid financial scams prevalent in India, such as phishing, Ponzi schemes, and fraudulent investment offers.

• AR Financial Advisor: Augmented reality feature that allows players to scan real-world financial documents (bills, bank statements, investment forms) and receive guidance through the game's interface.

• Regional Economic Events: More localized economic events based on state-specific factors, such as elections, natural resources, and regional industries.

Conclusion

Finance Fighter has successfully merged entertainment with education to create a unique financial literacy tool that resonates with Indian players. By grounding its gameplay in the realities of India's financial landscape, the game has made complex financial concepts accessible and engaging for millions.

What truly sets Finance Fighter apart is its deep understanding of Indian financial culture – from the importance of gold in family finances to the challenges of saving for children's education and marriage, from navigating the complexities of GST to taking advantage of government schemes.

The game's impact extends beyond entertainment, with countless players reporting that skills learned in Finance Fighter have helped them make better financial decisions in real life. In a country where financial literacy remains low despite economic growth, Finance Fighter is playing an important role in empowering Indians to take control of their financial futures.

With its commitment to regional customization, educational value, and community engagement, Finance Fighter is poised to continue its growth as India's leading financial education platform and gaming phenomenon.

Related Tags

Finance Fighter Indian Finance Game Financial Strategy Money Management Game Indian Financial Literacy Investment Game Indian Stock Market Game Personal Finance India Financial Education Game Indian Budget Game Rupee Currency Game Indian Banking GameThis game is recommended by daman games. To discover more quality Indian games, please visit daman games.